Business

Mortgage Rates Explained: What Homebuyers Need to Know

Buying a home is exciting, but let’s be honest, it can also feel overwhelming. One moment you’re picturing your future living room, and the next you’re staring at numbers that seem to change every single day. Among all those numbers, mortgage rates matter the most. They quietly decide how much your home will really cost over time.

Many homebuyers rush into decisions without fully understanding mortgage rates. Others delay buying because they are waiting for the “perfect” rate that may never arrive. The truth sits somewhere in between. Once you understand how mortgage rates work, what influences them, and how lenders calculate them, the process becomes far less intimidating.

This guide breaks everything down in plain English. No financial jargon overload. Just clear explanations, practical insights, and honest advice to help you feel confident when dealing with mortgage rates.

What Are Mortgage Rates?

Mortgage rates are the interest rates lenders charge you for borrowing money to buy a home. In simple terms, it is the cost of using the bank’s money over a long period, usually 15 to 30 years.

When you see a mortgage rate advertised, that percentage determines how much interest you will pay on top of the loan amount. Even a small difference in mortgage rates can change your monthly payment and total loan cost significantly.

For example, a lower rate means lower monthly payments and less interest over time. A higher rate means the opposite.

Why Mortgage Rates Matter So Much

Mortgage rates influence almost every financial aspect of homeownership.

They affect:

- Monthly mortgage payments

- Total interest paid over the loan term

- Home affordability

- Long-term financial stability

- Refinancing opportunities

Many buyers focus only on the home price. However, experienced buyers know that mortgage rates often matter even more than the purchase price itself.

How Mortgage Rates Are Determined

Mortgage rates do not appear randomly. They are influenced by a mix of economic factors, lender policies, and borrower qualifications.

Economic Factors That Influence Mortgage Rates

Mortgage rates tend to rise and fall with the broader economy.

Key influences include:

- Inflation trends

- Central bank policies

- Economic growth

- Employment levels

- Bond market performance

When inflation is high, mortgage rates often increase. When economic growth slows, rates may drop to encourage borrowing.

Lender-Specific Factors

Not all lenders offer the same mortgage rates. Each lender sets rates based on risk tolerance, operating costs, and market strategy.

Some lenders specialize in competitive rates for strong borrowers. Others focus on flexibility or faster approvals.

Borrower Qualifications

Your personal financial profile plays a major role in the mortgage rates you receive.

Important factors include:

- Credit score

- Debt-to-income ratio

- Down payment amount

- Employment history

- Loan type and term

Stronger financial profiles usually qualify for better mortgage rates.

Fixed vs Adjustable Mortgage Rates

One of the first choices homebuyers face is deciding between fixed and adjustable mortgage rates.

Fixed Mortgage Rates

Fixed mortgage rates stay the same throughout the life of the loan. Your monthly payment remains predictable, which many buyers find reassuring.

Benefits of fixed mortgage rates:

- Stable payments

- Easier budgeting

- Protection from rising rates

This option is popular with long-term homeowners.

Adjustable Mortgage Rates

Adjustable mortgage rates start lower but can change over time based on market conditions. These loans usually have an initial fixed period before adjustments begin.

Benefits include:

- Lower initial payments

- Potential savings if rates fall

- Suitable for short-term ownership

However, adjustable mortgage rates come with more uncertainty.

Different Types of Mortgage Loans and Their Rates

Mortgage rates also vary depending on the type of loan you choose.

Conventional Loans

These are standard loans not backed by government agencies. Mortgage rates for conventional loans depend heavily on credit score and down payment size.

Government-Backed Loans

Loans backed by government programs often offer more flexible qualification requirements.

Common examples include:

- FHA loans

- VA loans

- USDA loans

These loans may have competitive mortgage rates, especially for first-time buyers.

Jumbo Loans

Jumbo loans exceed standard loan limits. Because they involve higher risk, mortgage rates for jumbo loans are often slightly higher.

How Credit Scores Affect Mortgage Rates

Your credit score is one of the strongest predictors of mortgage rates. Lenders view higher credit scores as lower risk.

A higher score can mean:

- Lower interest rates

- Better loan terms

- Reduced insurance costs

Even a small improvement in credit score can result in noticeable savings over time.

The Role of Down Payments in Mortgage Rates

Down payments reduce lender risk. The more money you put down, the less risky the loan appears.

Benefits of larger down payments include:

- Lower mortgage rates

- Reduced private mortgage insurance

- Improved approval odds

However, many buyers successfully secure competitive mortgage rates with modest down payments when other factors are strong.

Mortgage Rates and Loan Terms

Loan term length also affects mortgage rates.

| Loan Term | Typical Rate Trend | Monthly Payment | Total Interest |

|---|---|---|---|

| 15-Year | Lower rates | Higher payments | Less interest |

| 20-Year | Moderate rates | Balanced | Moderate interest |

| 30-Year | Higher rates | Lower payments | More interest |

Shorter loan terms usually offer lower mortgage rates but higher monthly payments.

When Mortgage Rates Rise or Fall

Understanding rate movement helps buyers time their decisions more confidently.

When Rates Rise

Mortgage rates often rise during strong economic growth or when inflation increases. Lenders adjust rates to protect profit margins.

When Rates Fall

Rates may fall during economic slowdowns, market uncertainty, or policy changes aimed at stimulating borrowing.

However, timing the market perfectly is difficult, even for professionals.

Should You Wait for Lower Mortgage Rates?

This is one of the most common questions homebuyers ask. The answer depends on personal circumstances.

Waiting may make sense if:

- Your finances need improvement

- You expect higher income soon

- Your credit score is increasing

However, waiting too long can also mean rising home prices, which may offset lower mortgage rates.

How to Get the Best Mortgage Rates

Securing favorable mortgage rates requires preparation and strategy.

Improve Your Credit Profile

Pay bills on time, reduce debt, and correct credit report errors.

Compare Multiple Lenders

Rates vary widely. Comparing offers can save thousands over the life of a loan.

Lock Your Rate

Rate locks protect you from sudden increases while your loan is processed.

Consider Points Carefully

Paying points upfront can lower mortgage rates, but it only makes sense if you plan to stay in the home long enough.

Understanding APR vs Mortgage Rates

Many buyers confuse mortgage rates with annual percentage rates.

Mortgage rates reflect interest only. APR includes interest plus additional costs such as fees.

APR provides a clearer picture of total borrowing cost.

Mortgage Rates and Refinancing

Refinancing allows homeowners to replace an existing loan with a new one at different mortgage rates.

Common reasons to refinance include:

- Lower monthly payments

- Reduced loan term

- Switching from adjustable to fixed rates

- Cash-out options

Lower mortgage rates often trigger refinancing waves.

Common Myths About Mortgage Rates

There are many misconceptions that confuse buyers.

Myth: You Need Perfect Credit

While excellent credit helps, many buyers qualify for reasonable mortgage rates without perfection.

Myth: Rates Are the Same Everywhere

Mortgage rates vary by lender, location, and borrower profile.

Myth: The Lowest Rate Is Always Best

Sometimes lower rates come with higher fees. The best choice balances cost and flexibility.

Mortgage Rates and First-Time Homebuyers

First-time buyers often worry most about mortgage rates. Education is key.

Programs designed for first-time buyers may offer:

- Competitive interest rates

- Lower down payment options

- Reduced fees

Understanding available options can ease the process significantly.

Emotional Side of Mortgage Decisions

Buying a home is emotional. Mortgage rates add stress because they feel uncontrollable.

However, focusing on long-term affordability rather than daily rate changes helps maintain perspective. A home should support your lifestyle, not strain it.

How Mortgage Rates Impact Long-Term Wealth

Over time, mortgage rates influence how quickly you build equity and how much interest you pay.

Lower mortgage rates allow:

- Faster equity growth

- More money for savings or investments

- Improved financial flexibility

This long-term impact is often underestimated.

Final Thoughts on Mortgage Rates

Mortgage rates are not just numbers on a screen. They shape your financial future for decades. Understanding how they work gives you power as a buyer.

You do not need to predict the market perfectly. You need clarity, preparation, and realistic expectations. Focus on affordability, stability, and your long-term goals.

If you are planning to buy a home, take time to understand mortgage rates before signing anything. Knowledge leads to confidence, and confidence leads to better decisions.

If this guide helped you understand mortgage rates more clearly, share your thoughts or experiences. Your perspective may help someone else navigate their own homebuying journey.

Business

10 Powerful Team Work Quotes Every Leader Should Know

10 Powerful Team Work Quotes Every Leader Should Know

In today’s fast-paced business world, success rarely comes from individual effort alone. High-performing organizations thrive on collaboration, communication, and shared vision. That’s why team work quotes are more than just inspirational sayings—they’re reminders of what makes teams successful.

Leaders who embrace teamwork understand the value of guiding, motivating, and uniting their teams. The right words, shared at the right time, can inspire action, build trust, and improve morale. In this article, we’ll explore 10 powerful team work quotes that every leader should know, unpack their meaning, and show how they can be applied in real-world business settings.

Why Team Work Quotes Matter

Quotes have a unique ability to encapsulate deep wisdom in just a few words. Team work quotes motivate, clarify values, and reinforce cultural norms within a company. For leaders, they provide quick, memorable ways to convey essential messages about cooperation, responsibility, and mutual support.

Benefits of Using Team Work Quotes in Leadership:

- Inspire Collaboration: Encourages employees to work together toward shared goals.

- Boost Morale: A well-timed quote can lift spirits during challenging projects.

- Communicate Vision: Reinforces organizational culture and expectations.

- Foster Accountability: Reminds teams of their collective responsibilities.

- Encourage Reflection: Prompts team members to think about their role in achieving success.

By integrating team work quotes into meetings, presentations, or internal communications, leaders can reinforce these principles in a memorable and impactful way.

1. “Alone we can do so little; together we can do so much.” – Helen Keller

This classic quote emphasizes the exponential power of teamwork. No individual can accomplish everything alone, but collaboration multiplies impact.

Application:

- Encourage cross-functional collaboration during projects.

- Use the quote in team kick-off meetings to set the tone for joint effort.

2. “Coming together is a beginning, staying together is progress, and working together is success.” – Henry Ford

Ford’s words illustrate the stages of teamwork—from formation to cohesion to achievement.

Application:

- Highlight the importance of maintaining relationships, not just initiating projects.

- Use it during team-building sessions to emphasize commitment.

3. “None of us is as smart as all of us.” – Ken Blanchard

This quote reminds leaders that collective intelligence surpasses individual knowledge. Diverse perspectives lead to stronger solutions.

Application:

- Encourage brainstorming sessions that leverage multiple viewpoints.

- Remind team members to value input from all colleagues.

4. “It is literally true that you can succeed best and quickest by helping others to succeed.” – Napolean Hill

Hill emphasizes that supporting teammates is not just altruistic—it’s strategic. Mutual support accelerates individual and team growth.

Application:

- Create mentorship programs within teams.

- Reward employees who assist others in achieving goals.

5. “The strength of the team is each individual member. The strength of each member is the team.” – Phil Jackson

Jackson’s quote highlights the interdependence between individuals and the team. Personal development strengthens collective performance.

Application:

- Encourage continuous learning for individual skill growth.

- Show how each role contributes to overall success.

6. “Great things in business are never done by one person; they’re done by a team of people.” – Steve Jobs

Jobs reinforces that organizational success is the result of collaboration and shared responsibility, not solo effort.

Application:

- Use in presentations to emphasize collaboration in strategic initiatives.

- Inspire employees to contribute beyond their individual roles.

7. “Teamwork is the secret that makes common people achieve uncommon results.” – Ifeanyi Enoch Onuoha

This quote celebrates the transformative potential of teamwork. Ordinary individuals achieve extraordinary results when they collaborate effectively.

Application:

- Share in team meetings to motivate employees to embrace teamwork.

- Recognize collaborative achievements publicly to reinforce the message.

8. “Individually, we are one drop. Together, we are an ocean.” – Ryunosuke Satoro

Satoro’s metaphor beautifully captures the concept that unity creates scale and power beyond what individuals can achieve alone.

Application:

- Visualize collective progress in team dashboards or metrics.

- Use in corporate newsletters to remind teams of their shared goals.

9. “The way a team plays as a whole determines its success.” – Babe Ruth

Babe Ruth points out that individual talent is secondary to cohesive teamwork. Coordination and cooperation are key drivers of outcomes.

Application:

- Highlight this quote in performance reviews or team retrospectives.

- Encourage synergy rather than competition among team members.

10. “Collaboration allows us to know more than we are capable of knowing by ourselves.” – Paul Solarz

Solarz emphasizes the knowledge and innovation gained through collective effort. Collaboration expands learning and problem-solving capacity.

Application:

- Foster environments where knowledge sharing is rewarded.

- Promote team projects to solve complex challenges collaboratively.

How Leaders Can Use Team Work Quotes Effectively

- Inspire Meetings: Start weekly meetings with a quote to set a collaborative tone.

- Reinforce Values: Integrate quotes into company newsletters, emails, or internal platforms.

- Motivate During Challenges: Use quotes to remind teams of the power of working together during tough projects.

- Encourage Reflection: Ask team members to interpret quotes and relate them to daily work.

- Combine with Action Plans: Pair quotes with actionable strategies to reinforce practical application.

Table: Applying Team Work Quotes to Leadership Strategies

| Quote Source | Leadership Insight | Practical Action for Teams |

|---|---|---|

| Helen Keller | Collaboration multiplies impact | Promote cross-functional projects |

| Henry Ford | Cohesion leads to success | Conduct team-building exercises |

| Ken Blanchard | Collective intelligence surpasses solo | Organize group brainstorming sessions |

| Steve Jobs | Shared responsibility drives results | Encourage joint ownership of initiatives |

| Ryunosuke Satoro | Unity creates scale | Celebrate milestones collectively |

Conclusion

Team work quotes are far more than motivational words—they are tools that guide, inspire, and unite teams. Leaders who understand the value of collaboration and consistently reinforce it can create a culture where cooperation drives results.

The 10 quotes outlined in this article provide timeless wisdom that can be applied in real-world business contexts. From enhancing productivity to fostering innovation, these quotes remind us that the true power of any organization lies in the collective effort of its people.

Leaders who leverage team work quotes strategically can inspire action, boost morale, and build stronger, more cohesive teams. Start using these quotes today to reinforce collaboration and witness the transformative effect on your team’s performance.

Business

Negative Feedback Examples That Actually Work

Negative Feedback Examples That Actually Work

Giving negative feedback is often viewed as one of the most challenging tasks in any professional setting. Many managers and team leaders struggle with delivering criticism without demoralizing their employees. Yet, when handled correctly, negative feedback examples can become a powerful tool for growth, motivation, and performance improvement.

The key lies in crafting feedback that is clear, constructive, and actionable. This article explores real-world negative feedback examples that actually work, along with tips and strategies to make criticism productive and encouraging. By the end, you’ll understand how to turn negative feedback into a positive force that drives results.

Why Negative Feedback Is Important

Feedback is essential for personal and professional development. While positive feedback reinforces good behavior, negative feedback examples identify areas that need improvement and prevent recurring mistakes.

Benefits of Constructive Negative Feedback:

- Enhances Performance: Highlights opportunities for growth.

- Improves Communication: Encourages open dialogue between managers and employees.

- Builds Trust: Honest, respectful feedback fosters credibility.

- Drives Accountability: Employees understand expectations clearly.

- Supports Development: Focused criticism leads to skill improvement.

Without proper negative feedback, employees may continue inefficient behaviors, leading to reduced productivity and missed opportunities.

Principles of Effective Negative Feedback

Before diving into examples, it’s crucial to understand the principles that make feedback effective:

- Be Specific: Avoid vague statements like “You need to do better.” Instead, identify the exact issue.

- Focus on Behavior, Not Personality: Critique actions, not the person.

- Use the “SBI” Model: Situation-Behavior-Impact helps structure feedback clearly.

- Offer Solutions: Suggest actionable steps for improvement.

- Deliver Promptly: Provide feedback close to the event for better relevance.

- Maintain Respect: Keep the tone professional and encouraging.

Following these principles ensures that your negative feedback examples are constructive and motivating rather than discouraging.

Real-World Negative Feedback Examples

Here are practical negative feedback examples that you can adapt to various workplace scenarios.

1. Missed Deadlines

Example:

“During last week’s project, the report was submitted two days late. This delay impacted the team’s schedule. To improve, consider setting earlier personal deadlines or using project management tools to track progress.”

Why It Works: Specific, action-oriented, and highlights impact without attacking the individual.

2. Poor Communication

Example:

“In yesterday’s client call, some key points were unclear. Clearer explanations and summarizing action items will help ensure everyone understands your updates.”

Why It Works: Focuses on observable behavior and provides actionable improvement steps.

3. Low-Quality Work

Example:

“The recent marketing draft contained several factual errors. Double-checking references and using an editing checklist will prevent similar mistakes in the future.”

Why It Works: Encourages responsibility while offering a practical solution.

4. Lack of Initiative

Example:

“I noticed you didn’t volunteer for new tasks during the team meeting. Taking initiative on projects can demonstrate leadership potential and help you grow professionally.”

Why It Works: Highlights opportunity for growth instead of criticizing the individual directly.

5. Inconsistent Attendance

Example:

“There were three late arrivals last week. Consistent attendance is crucial for team productivity. Setting alarms or planning your commute can help address this issue.”

Why It Works: Objective, non-judgmental, and includes clear expectations.

6. Inefficient Time Management

Example:

“The presentation prep took longer than expected, which delayed the review process. Prioritizing tasks and creating a timeline can improve efficiency.”

Why It Works: Targets behavior, identifies impact, and provides solutions.

7. Misunderstanding Instructions

Example:

“The report included sections outside the project scope. Carefully reviewing instructions and asking clarifying questions will ensure alignment next time.”

Why It Works: Encourages clarification instead of assigning blame.

8. Resistance to Feedback

Example:

“During our review, your response seemed defensive. Accepting feedback openly will help you grow and strengthen team collaboration.”

Why It Works: Addresses attitude constructively while explaining consequences.

9. Missed Opportunities for Collaboration

Example:

“You worked independently on the task, which delayed input from others. Engaging teammates early can enhance project outcomes.”

Why It Works: Encourages teamwork without being punitive.

10. Low Engagement

Example:

“You’ve been quieter in meetings lately. Sharing your insights will benefit the team and demonstrate your expertise.”

Why It Works: Frames feedback positively and motivates participation.

Tips for Delivering Negative Feedback Effectively

- Choose the Right Setting: Private, respectful environments work best.

- Be Balanced: Mix positive and negative feedback where appropriate.

- Listen Actively: Encourage employees to respond and discuss solutions.

- Follow Up: Check progress and offer support after feedback is given.

These practices ensure that negative feedback examples are not only heard but acted upon.

Common Mistakes to Avoid

Even well-intentioned feedback can fail if delivered incorrectly. Avoid:

- Being Vague: General comments confuse employees.

- Attacking Personality: Criticism should never feel personal.

- Delaying Feedback: Late feedback loses context and impact.

- Ignoring Employee Input: Dialogue is key to acceptance and improvement.

Understanding pitfalls helps ensure feedback drives positive change.

Table: Feedback Framework Using SBI Model

| Situation | Behavior Observed | Impact on Team/Project | Suggested Action |

|---|---|---|---|

| Late project submission | Report submitted 2 days late | Delayed team workflow | Set internal deadlines, use tracking tools |

| Inaccurate marketing draft | Several factual errors | Client confusion, reduced credibility | Proofread, use checklist |

| Poor client communication | Key points unclear | Misalignment with client expectations | Summarize, clarify key points |

| Low engagement in meetings | Minimal input | Missed ideas, reduced collaboration | Participate actively, share insights |

Conclusion

Delivering negative feedback examples that actually work is both an art and a science. By focusing on behavior, offering actionable solutions, and maintaining respect, managers can turn criticism into a powerful tool for growth.

The examples shared show that negative feedback doesn’t have to demoralize—it can motivate, improve performance, and strengthen team collaboration. Effective feedback is timely, specific, and constructive.

Start applying these negative feedback examples today, observe the impact on team performance, and create a culture where feedback drives improvement and success.

Business

Return Outward is also known as: Full Meaning Explained

Return Outward is also known as: Full Meaning Explained

Accounting and banking terms can sometimes feel confusing, especially for beginners. One such term that often comes up is Return Outward. You may have heard your teacher, accountant, or banking professional say, “Return Outward is also known as…” but the explanation might not have been clear. This article aims to break it down in the simplest, most understandable way, using examples and practical insights so you truly grasp the concept.

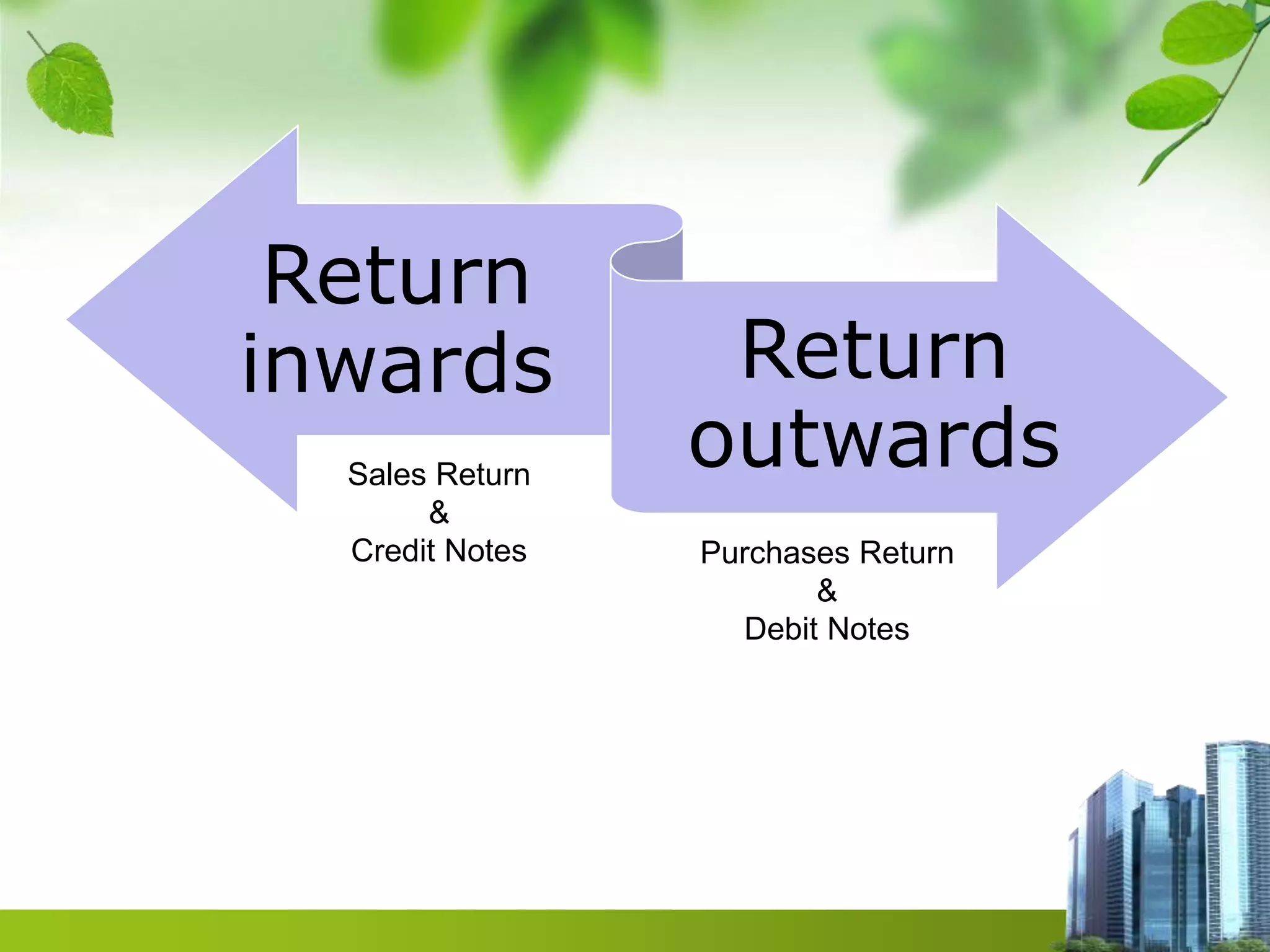

What is Return Outward?

In accounting and banking, Return Outward refers to cheques or payments that were issued by a company or individual but could not be processed or honored by the bank. These are essentially outgoing payments that have been returned.

Why is it Important?

Understanding Return Outward is critical for anyone dealing with financial transactions, bookkeeping, or banking. It helps in:

- Tracking failed or bounced payments

- Maintaining accurate accounting records

- Managing liabilities effectively

- Preventing financial discrepancies

Accounting Implications

When a payment is returned, the company must record it in the Return Outward Account. This ensures that the company is aware of obligations that were not fulfilled and can take necessary action.

Return Outward is also known as – Key Definitions

To make it simple, Return Outward is also known as:

- Bank Payment Order (BPO)

- Returned Cheque

- Dishonored Payment

These terms are often used interchangeably, depending on the context. For instance, in corporate accounting, you might hear Bank Payment Order, whereas in personal banking, it is usually referred to as a Returned Cheque.

Difference Between Return Outward and Return Inward

It is important to distinguish between the two:

| Term | Meaning |

|---|---|

| Return Outward | Outgoing payments returned by the bank due to insufficient funds or errors |

| Return Inward | Incoming payments returned to the payer due to bank issues or incorrect details |

This distinction helps in maintaining proper accounting records and understanding cash flow.

Causes of Return Outward

There can be several reasons why a payment or cheque is returned by the bank:

- Insufficient Funds – The payer’s account does not have enough balance.

- Incorrect Details – Mistakes in account number, payee name, or signature.

- Stopped Cheque – The issuer has instructed the bank not to honor the cheque.

- Technical Errors – Bank processing errors or system issues.

Understanding the cause is essential for taking corrective measures.

Accounting Treatment of Return Outward

Once a payment is returned, accountants follow specific steps to record it correctly. This ensures transparency and accuracy in financial statements.

Journal Entry Example

Assume a company issued a cheque of $5,000 that was returned due to insufficient funds. The journal entry would be:

| Date | Particulars | Debit ($) | Credit ($) |

| 01/01/2026 | Bank A/c | 5,000 | |

| Return Outward A/c | 5,000 |

This entry helps the company track returned payments and adjust its cash balances accordingly.

Ledger Accounts

The Return Outward Account is usually credited whenever a payment is returned. This helps in reconciling bank statements and monitoring liabilities.

Real-Life Examples

Example 1: Corporate Payment

A company issues a cheque to a supplier for $10,000. Due to insufficient funds, the cheque is returned. The company records this as Return Outward to track the unpaid liability and contact the supplier for a new payment arrangement.

Example 2: Personal Banking

An individual issues a cheque to a friend for rent payment. If the cheque bounces, it is recorded as a Returned Cheque and may also incur bank charges.

Example 3: Government or Tax Payments

When a tax payment is issued via cheque and is returned, it is also considered Return Outward, and immediate correction is required to avoid penalties.

Importance in Banking and Finance

The term Return Outward is also known as emphasizes its significance in both banking and accounting. By monitoring returned payments:

- Businesses can maintain better cash flow

- Banks can notify customers to resolve issues promptly

- Accountants can prevent misstatements in financial records

Common Misconceptions

Even professionals sometimes misunderstand Return Outward:

- Thinking it only applies to cheques (it applies to all bank payments)

- Confusing it with Return Inward

- Ignoring it in daily accounting, leading to inaccurate statements

How to Avoid Issues

- Verify account balances before issuing payments

- Double-check all cheque details

- Keep a record of all payments and monitor bank returns regularly

Benefits of Understanding Return Outward

Knowing Return Outward and its proper recording provides multiple advantages:

- Accurate tracking of liabilities

- Avoiding financial penalties

- Streamlined cash flow management

- Better communication with suppliers and banks

Tips for Beginners

If you are new to accounting, follow these tips:

- Always reconcile your bank statement monthly

- Maintain a separate Return Outward Ledger

- Understand causes of returned payments to prevent repetition

- Consult your accountant for complex transactions

Frequently Asked Questions (FAQ)

Q1: Is Return Outward only related to cheques?

No. While cheques are common, Return Outward applies to all outgoing payments returned by the bank.

Q2: What is the difference between BPO and Return Outward?

BPO (Bank Payment Order) is one form of Return Outward. All BPOs that fail are recorded as Return Outward.

Q3: How to record a returned cheque in accounting?

It is credited to the Return Outward Account and debited back to the Bank Account to adjust balances.

Q4: Can bank charges be added to Return Outward?

Yes, bank fees due to returned payments are usually recorded separately in the accounts as an expense.

Conclusion

Understanding Return Outward is also known as Bank Payment Order, Returned Cheque, or Dishonored Payment is essential for anyone in accounting, banking, or finance. By grasping its meaning, causes, and accounting treatment, businesses and individuals can maintain accurate records, avoid discrepancies, and manage cash flow effectively.

If you found this guide helpful, share it with colleagues or students, and comment below with your experiences handling Return Outward payments. Clear understanding leads to smarter financial management.

-

Business2 months ago

Business2 months agoMovierulz 2025 Explained: Risks, Safety, and Legality

-

Business1 month ago

Business1 month agoDoge HHS Migrant Housing Contract: What It Means Now

-

Celebrity4 weeks ago

Celebrity4 weeks agoMelissa Esplana: Life, Career, and Personal Story

-

Business1 month ago

Business1 month agoChris Rea’s Music Career: Hits, Albums, Legacy

-

Entertainment1 month ago

Entertainment1 month agoSalma Hayek Nude Scenes Explained in Film Context

-

Celebrity4 weeks ago

Celebrity4 weeks agoMickey Lee: Life Story, Career, and Personal Insights

-

LifeStyle4 weeks ago

LifeStyle4 weeks agoMichael Tell: Life, Career, and Personal Story

-

Business2 months ago

Business2 months agoNew York Giants vs Atlanta Falcons Match Player Stats Breakdown